08/12/2020

PRODUCT DIVERSIFICATION

Need of the Hour

A monthly session has begun in BGMEA with specific industry related topics. Product diversification was the topic of the first session where experts from think tanks, financial institutions, members, planning commission expressed their opinions and recommendations on the issue.

The session began with a power point presentation explaining the current product-wise export trends of Bangladesh RMG industry and potential areas of product and market diversification. The brief summery along with recommendation of the presentation as follows:

Bangladesh’s RMG industry has done well in terms of expansion and export growth in last few decades. But limited diversity is the major bottleneck in its growth sustenance. The industry is overwhelmingly concentrated in the following areas –

The session began with a power point presentation explaining the current product-wise export trends of Bangladesh RMG industry and potential areas of product and market diversification. The brief summery along with recommendation of the presentation as follows:

Bangladesh’s RMG industry has done well in terms of expansion and export growth in last few decades. But limited diversity is the major bottleneck in its growth sustenance. The industry is overwhelmingly concentrated in the following areas –

PRODUCT CONCENTRATION:

Around 76% of Bangladesh’s RMG export is concentrated in 18 products, which comprise of 54% of global imports. Whereas 36% of global clothing import is spread over 67 items having a global market size of 154 billion dollars, where Bangladesh’s export was 8 billion dollars only in 2018. Drilling further down in more disaggregated product categories in HS10 level for USA and HS8 for EU reveals the fact that each of the HS6 items consist of several sub-items in 8/10 digits level, and Bangladesh’s export is further concentrated in to few HS10 items (with exception of a few). The following table summarizes this scenario. For example, the item ‘cotton jersey / pullover – HS611020’ has 23 sub-categories in HS10 in USA. Of these 23 items 2 items make up between 80%-90% of HS611020’s export to USA from Bangladesh, meaning that the remaining 10%-20% export of this HS6 category comes from other 21 items.

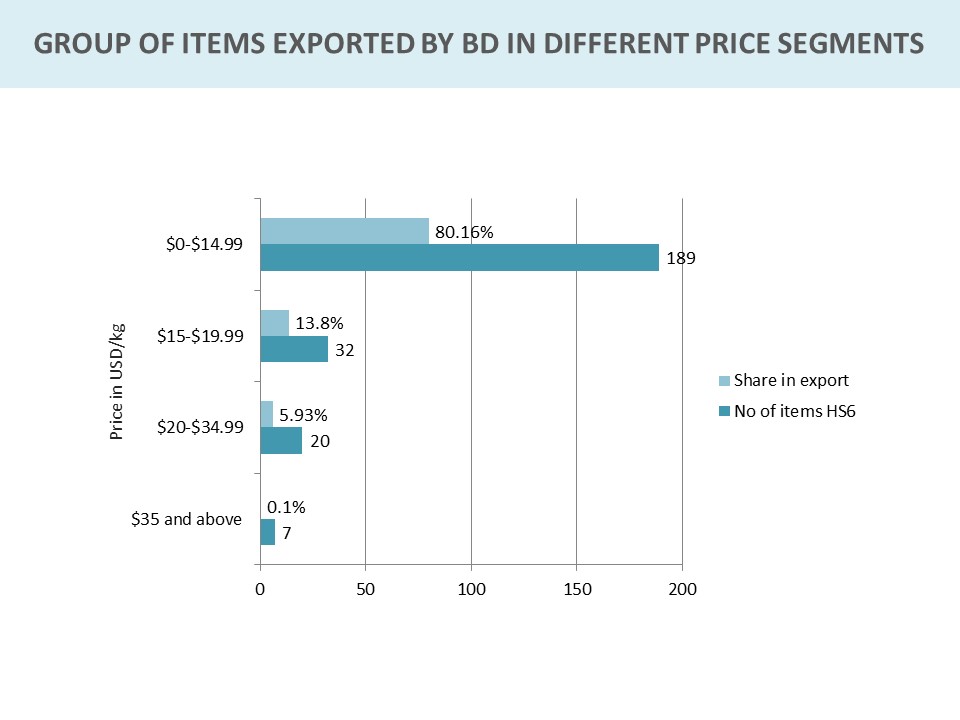

PRICE CONCENTRATION

Price of 80% exports ranges up to $15/KG. Bangladesh’s RMG exports are concentrated mostly in basic/commodity items. This has been a major weakness for the industry in negotiating price with the buyers. The declining unit price is a clear testimony to this fact. The Compound Annual Growth Rate of the unit value of apparel exported by Bangladesh has gone down by 1.61% between FY2015-16 and FY2018-19.

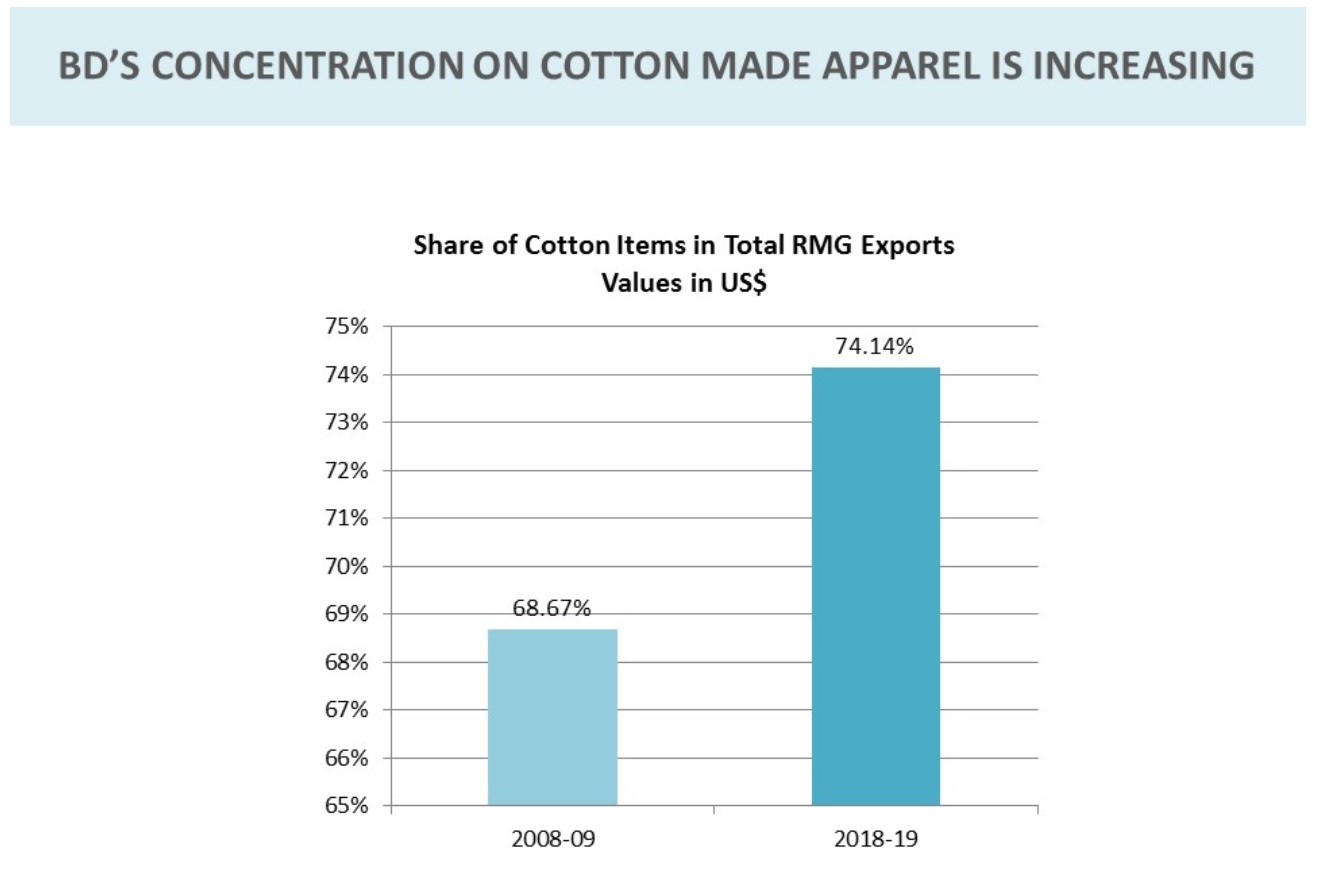

FIBER/MATERIAL CONCENTRATION

About 74.14% export is concentrated in cotton. The share of global trade of cotton-based apparel is around 35% which is shrinking at 0.5% CAGR between 2007–2017. On the other hand, the share of MMF based apparel is around 45% of the trade which is growing at 5% CAGR in the same period. In 2017, global trade of MMF based apparel was USD 150 billion, where Bangladesh had 5% share of it whereas Vietnam had 10% share.

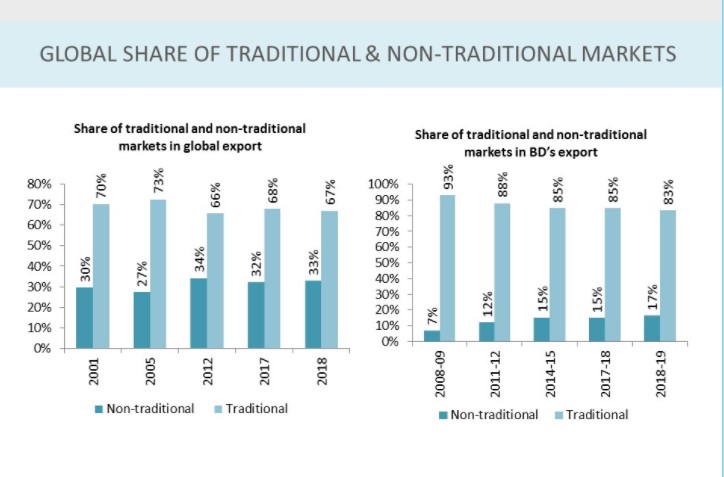

MARKET CONCENTRATION

Price Market diversification has always been limited and our exports are mostly concentrated to North America and European Market, which takes up around 83.34% share of our total RMG exports to the world. Over last few years the export market of Bangladesh's apparel has started being diversified and tremendous progress has been achieved in terms of new markets exploration.

RECOMMENDATIONS

Study on product diversification to identify potential products depending on their nature of complexity and industry’s readiness to expand in those categories, and progression toward up-market. Two lists of products were suggested for consideration in future expansion for medium and longer term investments. The first list is suggested for investments in 5 years containing 31 product items. Export value of these items last year was US$7 billion out of US$132 billion global trade. Of these items 19 are for women and girls and 17 cotton, and 14 non-cotton items. The other list contains 20 items in HS6, having global import market of $54 billion, and Bangladesh only exported $1.2 billion in 2018.

Focus future expansion in the area of non-cotton, women / girls clothing, outerwear / athleisure.

Explore buyers / retailers perspective on Bangladesh’s product diversification in terms of mismatch between buyers product portfolio from world and from Bangladesh.

Industry-wide capacity assessment and establishing a central database (Base National Capacity) to monitor future investments.

Following the presentation, the participants of the session took part in interactive discussion on the topic. While scaling up in product diversification is stressed for sustenance of the apparel industry of Bangladesh, the participants also recommended a number of short- and long-term steps including productivity improvement, product diversification, waste management, product development, innovation, and training. Maximizing the use of machines, efficiency enhancement, allowing FDI in MMF-based textile industry, reducing lead time are suggested for increasing competitiveness of the RMG industry. They also recommended devaluation of local currency against dollar, restructure of incentives, commercial diplomacy for bilateral trade benefits and better communication with stakeholders. The opinions and recommendations expressed by the participants in the session are as follows:

We need to think about investment or FDI in MMF based textile industry in Bangladesh. Four kinds of diversification are required now – 1) product 2) process 3) skill and 4) sector. It’s really important for stakeholders including government department and agencies to work in an organized way to address the challenges of the sector. Morocco has a full-fledged innovation center. A study can be carried out to identify problems of diversifying into new apparel items and requirements to address them. We can identify at least 5 to 10 items in terms of value and market size. Then we can approach the government including the planning commission seeking how they can help the sector to tap on the products.

Bangladesh is far behind in product development where our competitor countries put much importance on it. In Pakistan & Viet Nam, product development officials are highly paid employees. We require customized incentive package for product diversification. We also need to be careful in technology selection and efficient use of resources. Time is very important factor now in sourcing decision. What Govt. needs to do is to make at least two or three fully functional special economic zone instead of developing 100 zones at one take.

You need to focus more on factory improvement instead of product improvement. This responsibility falls on factories and leaders of the association. Association leaders should suggest which products should be immediately left and what to focus on. As global market demand is not increasing, you cannot create appetite using incentive structure. The existing incentive packages for the industry should be restructured.

If we want to diversify our products and markets, incentive is a must requirement. Also we need to increase our capacity in existing product basket. One thing is mandatory to mention that we are not aware of newer and upgraded technologies in our factory machinery and don’t even try to learn the modern, fast and easy methods which can be done with our existing machine set-ups. We need training on awareness build up regarding this. For example: if we use planning software properly, profit margin will be 30 to 40% higher.

Bangladesh is lagging behind its competitors in terms of product development and lead time. Lead time is a very important factor in taking sourcing decision. It takes around 13-17 days for Turkey to send products to the store. Even Pakistan is ahead in terms of product development. They offer buyers innovative products developed by them whereas Bangladesh still asks buyers what products they want us to manufacture for them. In China and Vietnam, factories have highly paid top officials for product development whereas in Bangladesh the weakest department in factories is product development team. Also Bangladesh needs to work on enhancing efficiency which is still low, around 43 percent. Factories should work on waste management, should have industrial engineers. Bangladesh has over capacity in product development. The industry has a capacity of 46 billion dollars but producing products worth 34 billion dollars.

We have to identify the stakeholders in the industry ecosystem and communicate with them to make them understand why and how this industry is important for the country. The perception that BGMEA always appeal to the government for support is needed to be removed. A platform can be created to bring all stakeholders together to communicate the message. Communication tools like video can be used in this regard. Sometimes, we need to appreciate policymakers and other stakeholders for their support to the industry. We also need to give importance to bilateral commercial diplomacy to explore trade opportunities in new markets.

Joint venture can be a way of increasing man-made fibre based production in Bangladesh. But countries like Sri Lanka, China are not interested to do joint venture in our country. But they do it in Viet Nam as ease of doing business is better there. If we want to avail this type of opportunity, we will actually have to facilitate them. We need to hire consultants who will guide BGMEA to find out market potentials. The consultant can guide what would be line layout of a specific product, which will be made public for factories. For example, outerwear is a big market. The consult can tell us what could be an ideal line for jacket production. Also we need to focus on larger markets rather focusing on small ones while selecting products for diversification.

High tariff is a major constraint on entering into new markets. For example, tariff rate in Brazil is 35 percent. Hence, additional incentives are required to enter into markets where tariff rates are high.

BGMEA can prepare a position paper outlining what kinds of supports the RMG industry needs to sustain. Based on this position paper the government will identify areas where it can lend its support to the industry.

RECOMMENDATIONS

Short-term:

• Product Development

• Lead time reduction

• Devaluation of local currency against dollar

• Incentives for product and market diversification

• Productivity enhancement

• Restructure of existing incentive package

• Targeting specific 5-10 products for diversification

• Study on finding out challenges in product diversification with suggestions to address them

• Recruitment of consultant to make guidelines of product diversification for factories

Long-term:

• Allowing FDI in MMF-based textile industry

• Improving ‘ease of doing business’

• Setting up product development/innovation center

Focus future expansion in the area of non-cotton, women / girls clothing, outerwear / athleisure.

Explore buyers / retailers perspective on Bangladesh’s product diversification in terms of mismatch between buyers product portfolio from world and from Bangladesh.

Industry-wide capacity assessment and establishing a central database (Base National Capacity) to monitor future investments.

Following the presentation, the participants of the session took part in interactive discussion on the topic. While scaling up in product diversification is stressed for sustenance of the apparel industry of Bangladesh, the participants also recommended a number of short- and long-term steps including productivity improvement, product diversification, waste management, product development, innovation, and training. Maximizing the use of machines, efficiency enhancement, allowing FDI in MMF-based textile industry, reducing lead time are suggested for increasing competitiveness of the RMG industry. They also recommended devaluation of local currency against dollar, restructure of incentives, commercial diplomacy for bilateral trade benefits and better communication with stakeholders. The opinions and recommendations expressed by the participants in the session are as follows:

We need to think about investment or FDI in MMF based textile industry in Bangladesh. Four kinds of diversification are required now – 1) product 2) process 3) skill and 4) sector. It’s really important for stakeholders including government department and agencies to work in an organized way to address the challenges of the sector. Morocco has a full-fledged innovation center. A study can be carried out to identify problems of diversifying into new apparel items and requirements to address them. We can identify at least 5 to 10 items in terms of value and market size. Then we can approach the government including the planning commission seeking how they can help the sector to tap on the products.

Bangladesh is far behind in product development where our competitor countries put much importance on it. In Pakistan & Viet Nam, product development officials are highly paid employees. We require customized incentive package for product diversification. We also need to be careful in technology selection and efficient use of resources. Time is very important factor now in sourcing decision. What Govt. needs to do is to make at least two or three fully functional special economic zone instead of developing 100 zones at one take.

You need to focus more on factory improvement instead of product improvement. This responsibility falls on factories and leaders of the association. Association leaders should suggest which products should be immediately left and what to focus on. As global market demand is not increasing, you cannot create appetite using incentive structure. The existing incentive packages for the industry should be restructured.

If we want to diversify our products and markets, incentive is a must requirement. Also we need to increase our capacity in existing product basket. One thing is mandatory to mention that we are not aware of newer and upgraded technologies in our factory machinery and don’t even try to learn the modern, fast and easy methods which can be done with our existing machine set-ups. We need training on awareness build up regarding this. For example: if we use planning software properly, profit margin will be 30 to 40% higher.

Bangladesh is lagging behind its competitors in terms of product development and lead time. Lead time is a very important factor in taking sourcing decision. It takes around 13-17 days for Turkey to send products to the store. Even Pakistan is ahead in terms of product development. They offer buyers innovative products developed by them whereas Bangladesh still asks buyers what products they want us to manufacture for them. In China and Vietnam, factories have highly paid top officials for product development whereas in Bangladesh the weakest department in factories is product development team. Also Bangladesh needs to work on enhancing efficiency which is still low, around 43 percent. Factories should work on waste management, should have industrial engineers. Bangladesh has over capacity in product development. The industry has a capacity of 46 billion dollars but producing products worth 34 billion dollars.

We have to identify the stakeholders in the industry ecosystem and communicate with them to make them understand why and how this industry is important for the country. The perception that BGMEA always appeal to the government for support is needed to be removed. A platform can be created to bring all stakeholders together to communicate the message. Communication tools like video can be used in this regard. Sometimes, we need to appreciate policymakers and other stakeholders for their support to the industry. We also need to give importance to bilateral commercial diplomacy to explore trade opportunities in new markets.

Joint venture can be a way of increasing man-made fibre based production in Bangladesh. But countries like Sri Lanka, China are not interested to do joint venture in our country. But they do it in Viet Nam as ease of doing business is better there. If we want to avail this type of opportunity, we will actually have to facilitate them. We need to hire consultants who will guide BGMEA to find out market potentials. The consultant can guide what would be line layout of a specific product, which will be made public for factories. For example, outerwear is a big market. The consult can tell us what could be an ideal line for jacket production. Also we need to focus on larger markets rather focusing on small ones while selecting products for diversification.

High tariff is a major constraint on entering into new markets. For example, tariff rate in Brazil is 35 percent. Hence, additional incentives are required to enter into markets where tariff rates are high.

BGMEA can prepare a position paper outlining what kinds of supports the RMG industry needs to sustain. Based on this position paper the government will identify areas where it can lend its support to the industry.

RECOMMENDATIONS

Short-term:

• Product Development

• Lead time reduction

• Devaluation of local currency against dollar

• Incentives for product and market diversification

• Productivity enhancement

• Restructure of existing incentive package

• Targeting specific 5-10 products for diversification

• Study on finding out challenges in product diversification with suggestions to address them

• Recruitment of consultant to make guidelines of product diversification for factories

Long-term:

• Allowing FDI in MMF-based textile industry

• Improving ‘ease of doing business’

• Setting up product development/innovation center

PARTICIPANTS

1. Ahsan H Mansur, Executive Director, PRI

2. Dr. Mustafa Abid, Tariff Commission

3. Dr. Zaidi Sattar, PRI

4. Khondaker Golam Moazzem, Director, Research (CPD)

5. ZiurRahman, Country Manager, H&M Bangladesh

6. Md Mahbub-ur Rahman, CEO and country head of Wholesale Banking, HSBC Bangladesh

7. Nurun Nahar, Deputy Chief, at Programming Division, Planning Commission

8. Sarwat Ahmed, Advisor, GIZ

From BGMEA:

9. Dr. Rubana Huq, President

10. Faisal Samad, Sr. Vice President

11. M.A. Rahim Feroz, Vice President (Finance)

12. Arshad Jamal (Dipu), Vice President

13. Miran Ali, Director

14. Kamal Uddin, Director

15. Rezwan Selim, Director

16. A.K.M Bodiul Alam, Director

17. Mohammad Abdul Momen, Director

18. Shahidul Haque Mukul, Director

19. Shehabudduza Chowdhury, Director

20. Masud Quader Mona, Director

21. Sharif Zahir, Director

22. Nazrul Islam, Director

23. Asif Ibrahim, Director

24. M. Arif Hossai, Chairman, Standing committee, Trade Fair

25. Wasim Zakaria, Chairman, Standing committee, RDTI

26. Khan Monirul Alm (Shuvo), Chairman, Standing committee, PR

27. U.M. Ashek, Chairman, Standing committee, Market Development-Japan

2. Dr. Mustafa Abid, Tariff Commission

3. Dr. Zaidi Sattar, PRI

4. Khondaker Golam Moazzem, Director, Research (CPD)

5. ZiurRahman, Country Manager, H&M Bangladesh

6. Md Mahbub-ur Rahman, CEO and country head of Wholesale Banking, HSBC Bangladesh

7. Nurun Nahar, Deputy Chief, at Programming Division, Planning Commission

8. Sarwat Ahmed, Advisor, GIZ

From BGMEA:

9. Dr. Rubana Huq, President

10. Faisal Samad, Sr. Vice President

11. M.A. Rahim Feroz, Vice President (Finance)

12. Arshad Jamal (Dipu), Vice President

13. Miran Ali, Director

14. Kamal Uddin, Director

15. Rezwan Selim, Director

16. A.K.M Bodiul Alam, Director

17. Mohammad Abdul Momen, Director

18. Shahidul Haque Mukul, Director

19. Shehabudduza Chowdhury, Director

20. Masud Quader Mona, Director

21. Sharif Zahir, Director

22. Nazrul Islam, Director

23. Asif Ibrahim, Director

24. M. Arif Hossai, Chairman, Standing committee, Trade Fair

25. Wasim Zakaria, Chairman, Standing committee, RDTI

26. Khan Monirul Alm (Shuvo), Chairman, Standing committee, PR

27. U.M. Ashek, Chairman, Standing committee, Market Development-Japan

Data Source: EPB